illinois employer payroll tax calculator

If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our Taxpayer Assistance. Number of Allowances State.

Different Types Of Payroll Deductions Gusto

What Are Employer Unemployment Insurance Contribution Tax Rates.

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

. To use our Illinois Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Calculating your Illinois state income tax is similar to the. Just enter in the required info below such as wage and W-4.

Use ADPs Illinois Paycheck Calculator to calculate net take home pay for either hourly or salary employment. Ad Process Payroll Faster Easier With ADP Payroll. Illinois tax year starts from July 01 the year before to June 30 the current year.

State Experience Factor Employers UI Contribution Rates - EA-50 Report for 2017 EA-50 Report for 2018 EA-50 Report for. Ad Find 10 Best Payroll Services Systems 2022. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

Save Money Make Payday a Breeze With These Top Brands - No Prior Knowledge Required. Discover ADP Payroll Benefits Insurance Time Talent HR More. Newly-created businesses employing units must register with IDES within 30 days of start-up.

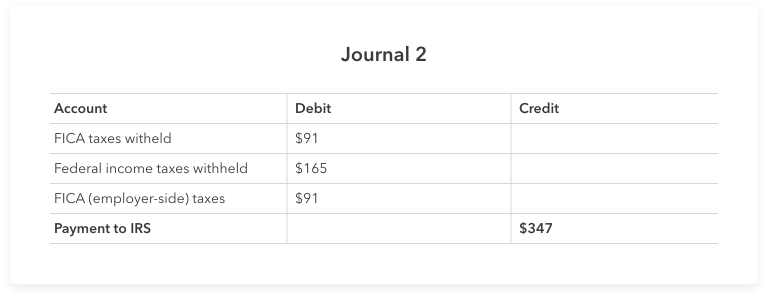

Federal tax rates like income tax. Number of Qualifying Children under Age 17. Payroll tax actually includes two different taxesSocial Security and Medicare folded into one known as the Federal Insurance Contributions Act FICA.

Withhold 62 of each employees taxable wages until they earn gross pay of 142800 in. 2021 Social Security Payroll Tax Employee Portion Medicare Withholding 2021 Employee Portion Illinois Individual Income Tax. Published January 21 2022.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Remit Withholding for Child Support to. Illinois child support payment information.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Both employers and employees are responsible for payroll taxes. Ad Process Payroll Faster Easier With ADP Payroll.

Get Started With ADP Payroll. Ad Payroll So Easy You Can Set It Up Run It Yourself. An employee can use the calculator to compare net pay with different number of allowances marital status or income levels.

Social Security accounts for 124 of payroll tax. The standard FUTA tax rate is 6 so your max contribution per. If would like to change your current withholding please complete a new W-4P and send it to the contact.

After a few seconds you will be provided with a full breakdown of the tax you are. Ad Compare This Years Top 5 Free Payroll Software. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck calculator.

Save Money Make Payday a Breeze With These Top Brands - No Prior Knowledge Required. So the tax year 2021 will start from July 01 2020 to June 30 2021. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Illinois residents only.

To contact the Chicago Department of Revenue please call 217-782. Check if you have multiple jobs. Free Unbiased Reviews Top Picks.

Choose Marital Status Single or Dual Income Married Married one income Head of Household. Free Unbiased Reviews Top Picks. Illinois State Disbursement Unit.

Online - Employers can register through the MyTax Illinois. Ad Find 10 Best Payroll Services Systems 2022. Employers can fill the information in a paystub generator Illinois about their.

Overview of Illinois Taxes Illinois. This article is part of a larger series on How to Do Payroll. All Services Backed by Tax Guarantee.

Get Started With ADP Payroll. The paystub generator Illinois tool may help you manage your payroll and create stubs for your employees efficiently. The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income Tax Rates.

Enter the amount figured in Step 1 above as the total taxable wages on line 1a of the withholding worksheet that you use to figure. Affordable Easy-to-Use Try Now. It is not a substitute for the advice of an.

Ad Compare This Years Top 5 Free Payroll Software. Affordable Easy-to-Use Try Now. An employer can use the calculator to compute and prepare paychecks.

Carol Stream IL 60197-5400. It simply refers to the Medicare and Social Security taxes employees and employers have to pay. Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return.

Payroll Tax What It Is How To Calculate It Bench Accounting

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Payroll Deductions Calculator For Estonian Companies Enty

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

How To Set Up Pay Payroll Tax Payments In Quickbooks

Payroll Tax What It Is How To Calculate It Bench Accounting

Istudy Bookkeeping And Payroll Services Are Common In Eve Payroll Accounting Payroll Bookkeeping

Payroll Tax What It Is How To Calculate It Bench Accounting

:max_bytes(150000):strip_icc()/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

2022 Federal Payroll Tax Rates Abacus Payroll

A Visual Representation Of How To Do Your Payroll Taxes Infographic Payroll Taxes Payroll Accounting Payroll

Income Taxes Preparing A U S Tax Form With Money In Mind Sponsored Preparing Taxes Income Tax Mind Ad Income Tax Tax Refund Tax Services

What Is Payroll Accounting A Guide For Small Business Owners Article

Aflac Supplemental Insurance Information Aflac Insurance Life